Insurance Marketing Letters

- Hasmaki Kuintaly

- Nov 14, 2022

- 1 min read

Insurance sales letters should make your prospective customers feel like they can trust you. They should be personalized to emphasize the benefits of your policy. They should be detailed, but not over-laden with information. Adding a sense of mystery can entice prospects to ask questions and explore the details. It's also a good idea to include contact information, including a phone number, email address, or username for social networking accounts.

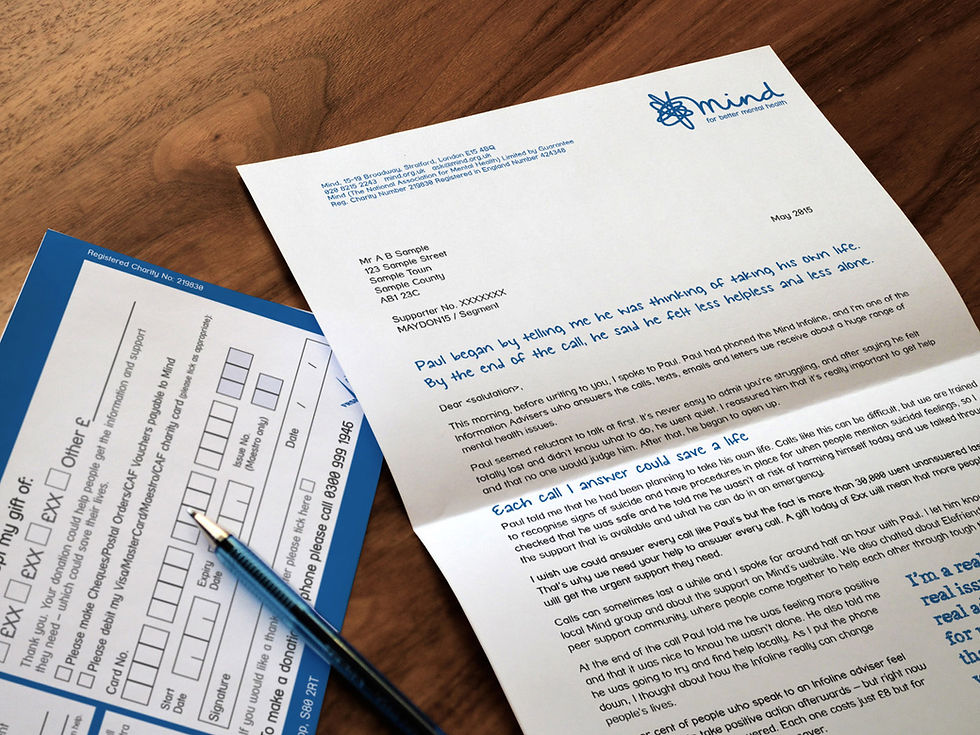

Insurance marketing letters should be written on a professional letterhead. Always include a signature and make sure to sign the letter with a delivery receipt. The first paragraph of your letter should be as brief as possible, with just enough information to compel your prospects to continue reading. Likewise, use short sentences that are no more than twenty words. Using color in your copy will make your prospects want to read the rest of the letter.

Insurance letters should be well-written, with plenty of white space to avoid the letter from appearing too cluttered. If possible, include a bullet-point list at the center of the letter. People tend to skip over the first few paragraphs to look at a bullet-point list. Make sure to include important phrases, such as 'call us now', 'low-interest', or 'best offer'.

Another important detail to include in an insurance letter is the policy period. The policy period is the period of time the policy is valid. Typically, this period is one year and starts at the time of renewal.

SITES WE SUPPORT

SOCIAL LINKS

Comments